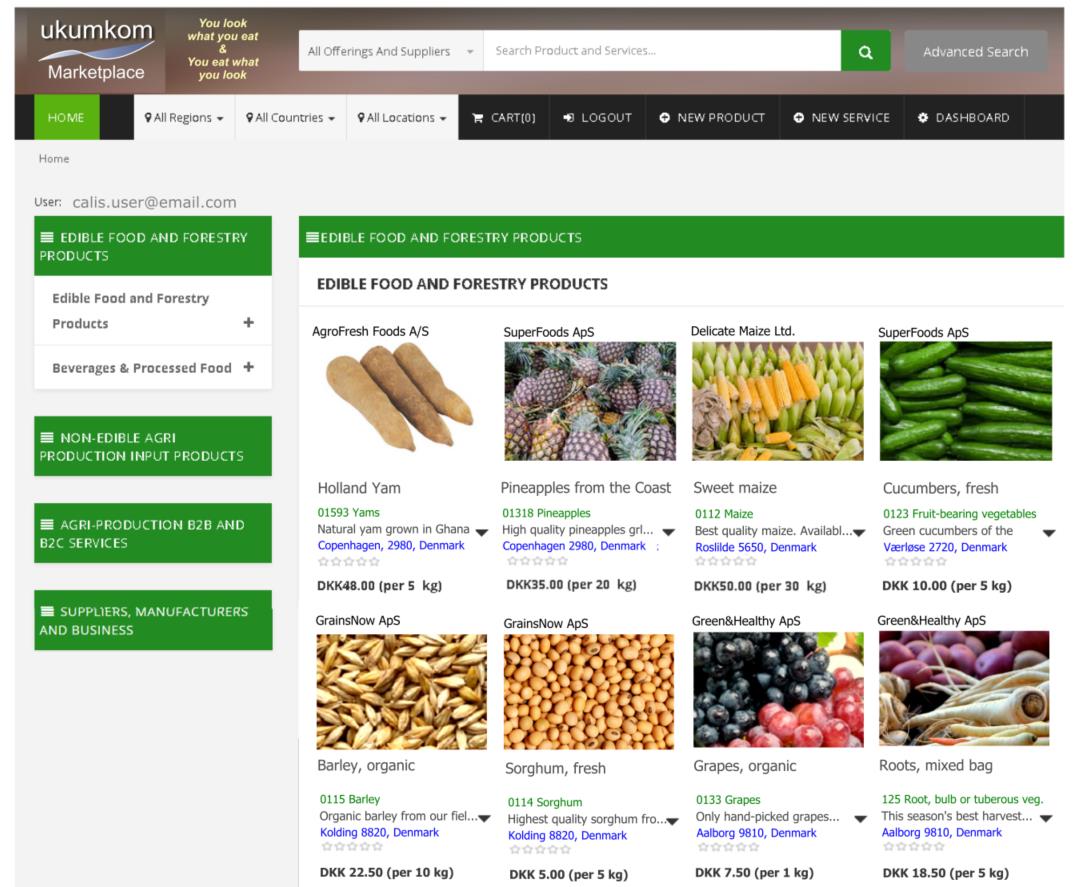

Ecommerce and Marketplace for Agro Products, Services and Resources

The eCommerce marketplace is for marketing and advertising B2B/B2C Agribusiness products and services. Serves as a hub for Agribusinesses and professional networking activities, as well as provides other services for navigation, mapping, geo-advertising, security and law enforcement tracking for organisations and national food authorities. Example is tracking and tracing agricultural products and services Our eCommerce platform is a unique product for marketing and advertising Agribusiness products and services. Its functionality is comparable to Alibaba and Amazon and agriproducts and services from the regions of Nordic, Baltic, EU, Europe, Asia, America, Africa and global can be advertised and sold here.

See More